Are you interested in using prevention alerts to reduce chargebacks? There are three ways you can access and manage the solution.

Want a high-level overview of how prevention alerts work? Check this article first.

OPTION #1

Integrate through a partner and automate

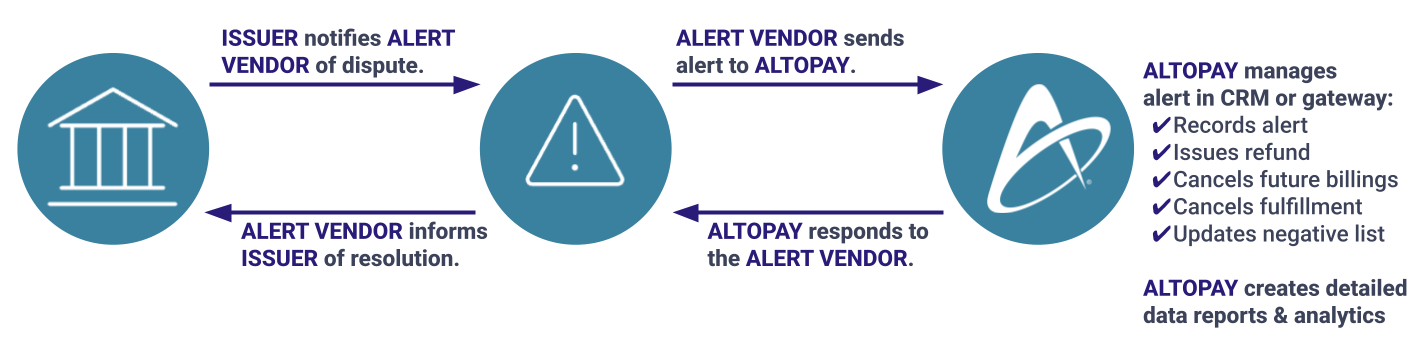

We’ll start with the most efficient option: receiving alerts via a partner that can automate the management process — such as AltoPay®.

This option usually has the highest ROI because it has the lowest risk of errors. However, it does require the use of an integrated CRM or gateway.

Here’s how it would work.

The entire process looks like this.

Here are features and benefits of this integration option via AltoPay.

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

If you would like to learn more about this integration option, let us know.

OPTION #2

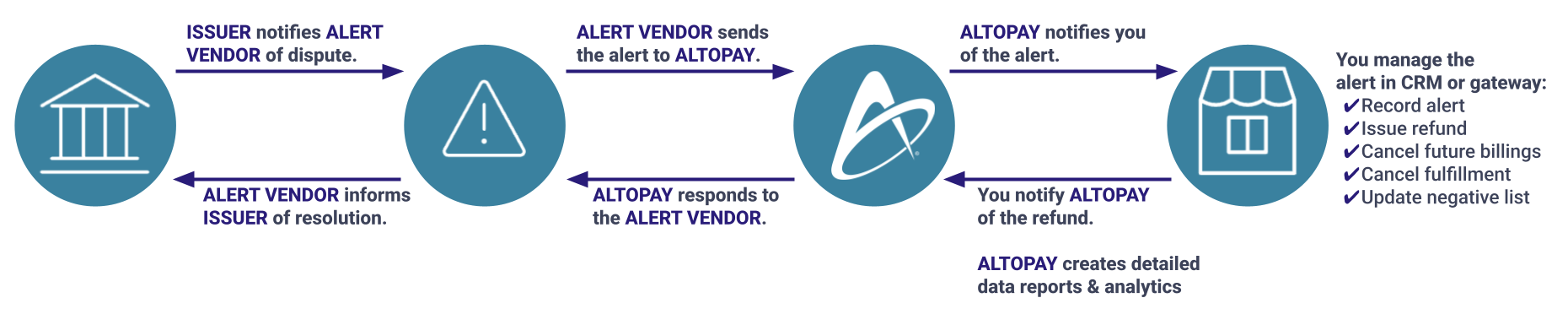

Sign up with a partner and manually work alerts

The second option is very similar to the first. You would still sign up for alerts via a partner — such as AltoPay. But there are two main differences between option #1 and option #2.

- This option does not require an integration.

- This option does not offer full automation.

This strategy can be beneficial. And amongst smaller merchants, it is the most commonly used option.

Here’s how it would work.

The entire process looks like this.

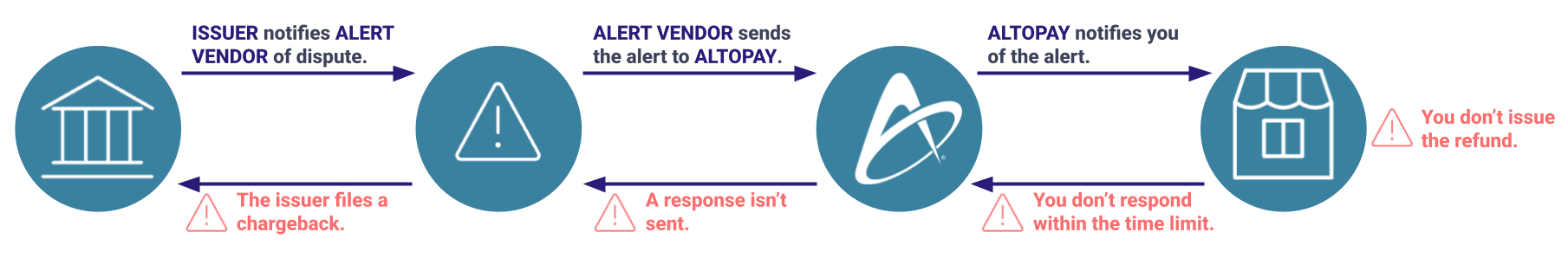

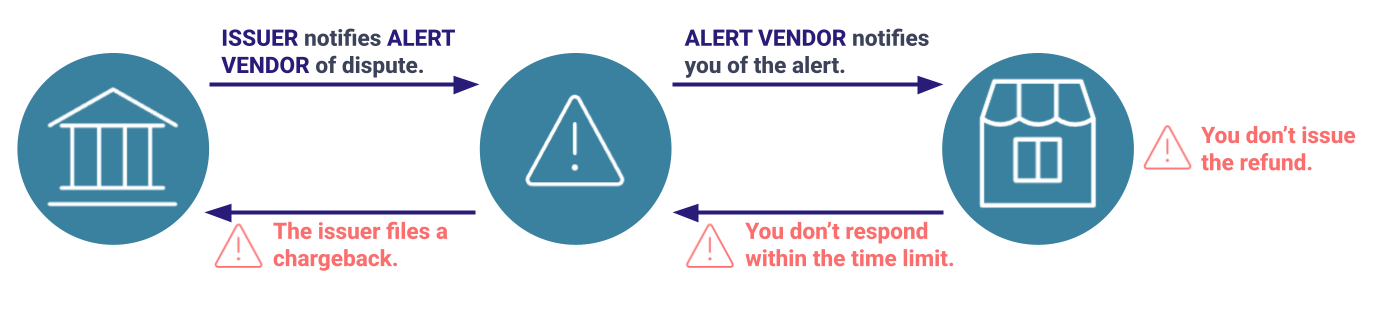

Unfortunately, because this strategy doesn’t use automation, there is a chance for errors. If you don’t issue the refund or don’t respond within the time limit, the alert will probably turn into a chargeback.

Fortunately, there are a couple ways to minimize this risk.

For example, you could rotate staffing responsibilities during the weekends and holidays so someone is always responding to alerts as they are issued. You could also sign up for Rapid Dispute Resolution (RDR) to catch any alert cases that slip through the cracks.

Here are features and benefits of a manual option via AltoPay.

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

If you would like to learn more about this integration option, let us know.

OPTION #3

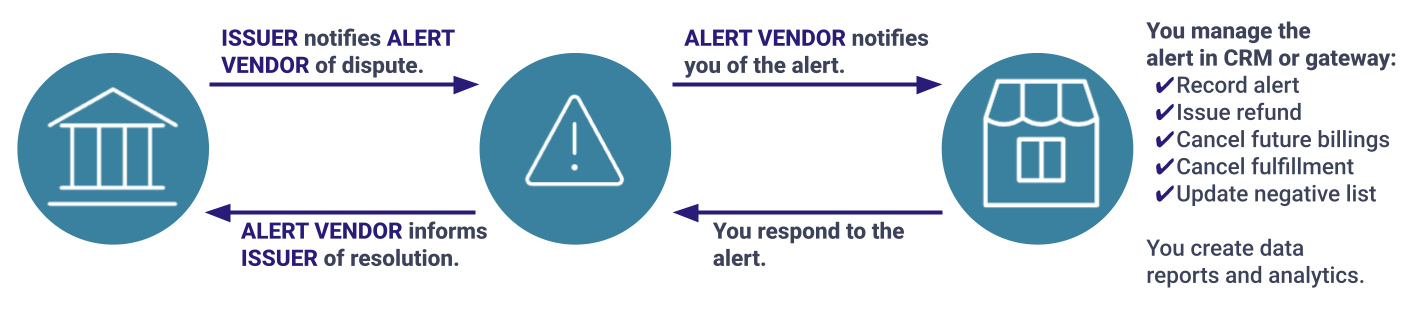

Work directly with Ethoca and/or Verifi

You can always work with Ethoca and Verifi directly. But this option means you are fully responsible for everything — which can be expensive, time consuming, and error prone.

Here’s how this option works.

The entire process looks like this.

Because this process isn’t automated, you do run the risk of errors and missed opportunities.

Again, there are ways to minimise those risks.

Here are features and benefits of this integration option.

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

Detailed, real-time reporting

Both Ethoca and Verifi

Data and management consolidated in one platform

Full automation

Support and insights to optimise ROI

No minimum volume requirements

Ready to start the integration process?

Are you ready to get started? Reach out to our team. We’ll help you determine the best integration option so you can maximise ROI.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.