Prevention alerts are a valuable risk management tool. They can help you refund disputed transactions to avoid chargebacks.

However, they aren’t able to resolve all disputes. And there are a couple of reasons why.

Want a high-level overview of how prevention alerts work? Check this article first.

Reasons why an alert can’t resolve a dispute — and how to increase protection

There are a couple circumstances where an alert might not be able to stop a chargeback. Let’s take a look at the different situations and explore options to improve outcomes.

NOTE

Before we share what may appear to be bad news, let us be clear about one thing.

Prevention alerts are a valuable chargeback management technique.

Unfortunately, there is no way to totally and completely eliminate chargebacks. You will always be exposed to some risk.

So while prevention alerts aren’t perfect, they are effective. Check this article for the full story.

The issuing bank hasn’t integrated with an alert network.

Before we talk about integration requirements, let’s take a quick look at how prevention alerts work.

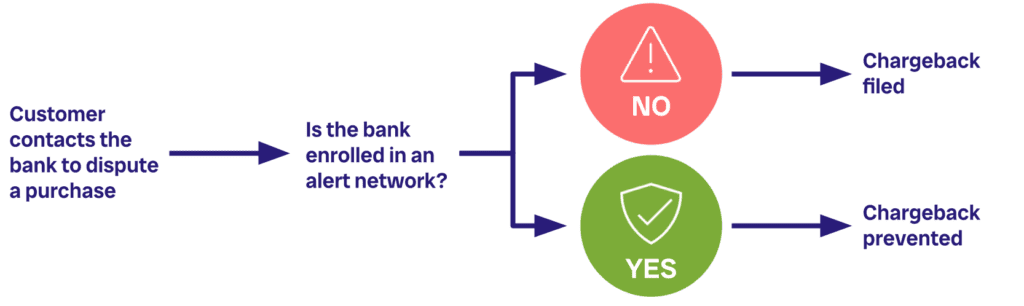

- A cardholder disputes a purchase.

- The cardholder’s bank (issuer) pauses the chargeback process for 24-72 hours and alerts you to the dispute.

- If you refund and respond within the time limit, the dispute won’t advance to a chargeback.

For all of that to happen, both you and the issuing bank have to be integrated with either Ethoca or Verifi’s technology.

If one of you isn’t a part of an alert network, you can’t communicate. And if an alert can’t be used to resolve the issue, the only option the bank has is to continue with the dispute process — which could mean filing a chargeback.

Integration to an alert network is optional. Issuing banks don’t have to use this chargeback prevention technology. And some choose not to.

Fortunately, prevention alerts aren’t the only available chargeback management tool. You can add additional layers of protection to catch cases that slip through the cracks in alert networks.

For example, you can add Visa’s Rapid Dispute Resolution (RDR) to your chargeback prevention strategy.

Like prevention alerts, RDR allows you to refund disputed transactions to stop chargebacks from happening.

Unlike prevention alerts, the RDR functionality is built into existing Visa technology. So all Visa issuing banks have access.

So if issuing banks aren’t part of an alert network, they still have a way to work with you directly to refund disputes without automatically filing a chargeback.

You aren’t using both Ethoca and Verifi.

Again, network enrollment is optional. Banks can choose which — if any — network they want to join. Some might choose both Ethoca and Verifi. Some might just pick one.

If you are only enrolled in one network — let’s say Ethoca — and the issuer is enrolled in the other — let’s say Verifi — there is no way to communicate.

So if you are only using one network, you are limiting your prevention alert coverage.

Resolving this issue is kind of obvious — if you are only using one alert network, consider adding the other!

Receiving both Ethoca and Verifi alerts maximises your protection. And if you use the right solution provider, managing the two can be easy and cost effective.

You aren’t able to match the alert to the original transaction.

When an alert is issued, the notification includes several data points to help you identify the transaction that has been disputed.

Some of the data includes:

- The first 6 and last 4 digits of the cardholder’s account number

- The transaction date

- The dispute amount

Usually, this information is enough to help you locate the transaction. But sometimes, you might not find a match.

Here’s a hypothetical example.

You processed the transaction. A week later, the bank sends the cardholder a new card because the original card has expired. The new card has a new account number. The following month, the cardholder disputes the purchase. And an alert is sent — with the new card information. But you have the old card details.

How will you know which transaction to refund?

The inability to match alerts to transactions is a common management “mistake”. We provide a detailed guide to help minimise mistakes — including how to improve match rates. Check it out: 9 Alert Management Mistakes & How to Troubleshoot

You can no longer issue refunds.

If your merchant account has been closed, you may not be able to issue refunds when alerts come in. Therefore, disputes will most likely advance to chargebacks.

Unfortunately, there isn’t much you can do in this situation. If a dispute is raised, there isn’t really a way to resolve it.

Your best bet in this situation is to un-enroll from prevention alerts and channel your efforts into managing chargebacks when they do come in.

You didn’t respond within the time limit.

In order for an alert to prevent a chargeback, you usually have to do two things:

- Issue a refund

- Respond to the alert

And you have to do both of those things within the 24-72 hour time limit. If you don’t, the case will probably advance to a chargeback.

The most efficient way to improve outcomes is to automate the refund and response process. You can virtually eliminate missed deadlines.

If automation isn’t an option, see if you can rotate staffing responsibilities during weekends and holidays. Try to have someone always be available to respond to alerts as they are issued.

To learn more about automation options and the integration requirements, check this article: 3 Integration Options for Prevention Alerts

You didn’t enroll all your billing descriptors.

A billing descriptor is the short descriptive text that appears on a cardholder’s bank statement to explain a purchase.

And billing descriptors are what alert vendors use to match a disputed transaction to the business that processed it.

Your business has a main billing descriptor that was set when you opened the account. But your descriptor can change slightly on a transaction by transaction basis. For example, your descriptor might appear one way for debit card purchases and another way for credit card purchases.

So when you sign up for prevention alerts, it’s important to enroll all the possible variations of your billing descriptor. Because if you don’t, then an alert can’t be sent and the case will probably advance to a chargeback.

The best way to determine your billing descriptor variations is to make several test purchases with your own cards and then check your statements.

When you make test purchases, use different cards (Visa, Mastercard, debit, credit, etc.). This will give you the most complete list of variations.

Once you have a list of possible descriptors, make sure you enroll them all with your vendor(s) of choice.

Want the most complete protection possible?

The tips we’ve shared here relate to optimising prevention alerts. But there are dozens of other things you can do to improve your chargeback prevention strategy.

Check our detailed guide to learn more.

RELATED READING

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.