Have you heard someone mention prevention alerts? Ethoca? Verifi? CDRN? Wondering how alerts work and if they could help your business?

Check out our high-level overview of this chargeback prevention technique.

What is a prevention alert?

A prevention alert allows you, the merchant, to resolve a customer’s payment dispute before it progresses to a chargeback by refunding the disputed transaction.

Think of a prevention alert as one of those red, flashing sirens that warns you when something has gone wrong.

And by “gone wrong,” we mean a transaction you processed has been disputed.

Just like any other situation where sirens are going off, you have two choices:

Ignore the warning and take your chances

If you receive an alert and do nothing, the dispute will advance to a chargeback.

Try to resolve the issue before it gets worse

If you heed the warning, you can try to solve the problem and stop the chargeback.

Why should I care about prevention alerts?

What are the benefits of prevention alerts? Why should you consider adding them to your chargeback prevention strategy?

Here is a high-level overview of what you could gain.

- Lower chargeback rates. This first benefit is usually the biggest and most obvious draw. If you can stop chargebacks from happening, you’ll help improve the reputation of your business and enjoy more stable, reliable payment processing.

- Solve problems quicker. A lesser known benefit of alerts is the gift of time. Chargeback notices usually take 2-5 weeks to reach you. But alert notifications happen in near real time. So you can identify and solve the underlying reason for disputes much faster, helping to eliminate future chargebacks that would otherwise be inevitable.

- Save the cost of goods. Again, alert notices come in quickly. Sometimes, they are quick enough to stop order fulfillment before your valuable merchandise is shipped out to fraudsters.

How do alerts work?

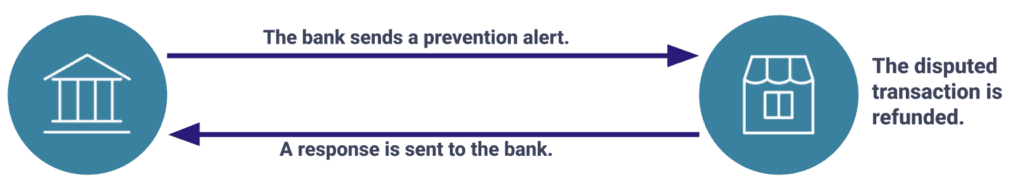

Prevention alerts work in sort of a down-and-back relay race.

Here’s the “down” portion of the relay:

STEP #1: The transaction is disputed. Either the bank detects fraud or the cardholder reports a problem.

STEP #2: Instead of immediately filing a chargeback, the bank pauses the dispute process and issues an alert.

STEP #3: You receive the alert. While the dispute is paused (24-72 hours), you investigate the case. Usually, you’ll discover one of two things.

- The transaction has already been refunded so a chargeback isn’t needed.

- The transaction should be refunded to stop the chargeback from happening.

Of course, there is always the option to ignore the alert and take your chances with a chargeback. But this option is very rarely used. Prevention alerts come with a fee. It’s unlikely that you’d want to pay for a service and not use it.

Now, here’s the “back” portion of the relay:

STEP #4: You respond to the alert and give the bank an update. The most common response options are that you issued the refund after being notified or perhaps the transaction had already been refunded.

STEP #5: The bank receives the alert response. The dispute will be dismissed without advancing to a chargeback.

STEP #6: The cardholder’s account is credited via the refund you issued. The case is considered closed.

NOTE

One of the primary intentions of prevention alerts is to help you avoid chargebacks. However, if certain steps aren’t taken, the alert won’t successfully resolve the dispute.

The two essential tasks are:

- Issuing the refund.

- Responding to the alert.

Both actions need to happen as soon as possible. An alert will only pause the dispute for 24-72 hours (depending on the type of alert you receive). You need to both refund and respond within that time limit.

Here’s a simplified visual of the down-and-back process.

RELATED READING

Want to take a deep dive into all the nuances of the prevention alert process? Check our more detailed guide.

Are there different types of alerts?

Prevention alert solutions are provided by two different vendors:

- Ethoca

- Verifi (Verifi calls their product Cardholder Dispute Resolution Network or CDRN)

The alert functionality is basically the same for both vendors. There are a few small differences that you should be aware of if you decide to use prevention alerts to protect your business.

RELATED READING

Here are a couple high-level things to know about the two vendors.

- You can and probably should receive alerts from both Ethoca and Verifi. It’s not an either-or decision. Using multiple solutions means you have multiple layers of protection.

- You can go directly to Ethoca and/or Verifi to receive prevention alerts — but you don’t have to. Ethoca and Verifi have partnered with solution providers — like AltoPay® — to help customers get better results from their networks. The main reasons are: you can get alerts from both vendors in a single platform, you’ll have access to more data, you have the ability to automate the workflow, you can optimise your alerts, and you can get advice on how to improve your outcomes. Check our article to learn more about the perks of working with a qualified reseller.

RELATED READING

Will I get an alert for every disputed transaction?

Prevention alerts can help you resolve some — but not all — disputes. Some cases will still advance to chargebacks.

These are the most common reasons why.

- The cardholder’s bank isn’t integrated with prevention alert technology.

- You aren’t able to issue a refund (for example, if your merchant account has been closed or you can’t match the alert to the original transaction).

Check our related article to learn more.

RELATED READING

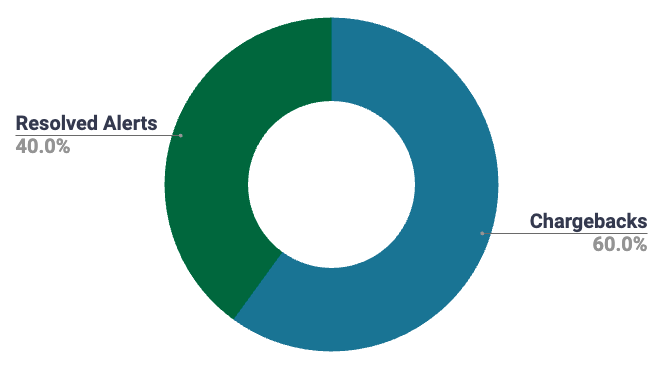

Usually, merchants who use both Ethoca and Verifi alerts are able to prevent about 30-40% of disputes from becoming chargebacks.

How do I know if alerts are a good fit for my business?

There are dozens of tools and hundreds of techniques to prevent chargebacks. Are prevention alerts right for your business?

Any online business can benefit from prevention alerts. But there are a couple business types and industries that can benefit the most. If any of these characteristics apply to you, you will probably want to at least consider using prevention alerts.

- You sell (or want to sell) internationally. Each individual market has its own unique risks and challenges. Prevention alerts can help level the playing field and add a universal layer of protection.

- You sell physical goods. When a chargeback is filed, it usually takes 2-5 weeks for the notification to reach your desk. A lot can happen during that time — including order fulfillment. But alert notifications happen in near real time. So you could potentially stop shipments before merchandise is sent out to fraudsters, saving you the cost of goods.

- You sell goods or services with a free trial option. Offering a free trial is a great way to increase conversions and make more sales. However, they typically lead to a higher-than-average chargeback rate. You’ll want to proactively address the inevitable risk.

- You are (or think you will be) enrolled in a chargeback monitoring program. Card brands (Mastercard®, Visa®, etc.) set limits for how many chargebacks your business can receive in a month. If you go over that limit, you could be put into a monitoring program (which includes various penalties and fines). If you are enrolled in the program too long, your merchant account might be terminated. In these situations, you need to quickly lower chargeback activity. And prevention alerts is a proven-effective technique.

- You want more merchant accounts. When you apply for a new merchant account, you have to prove the validity of your business. One way you can do that is to add prevention alerts to the accounts you already have. Help prospective processors recognize that you can effectively manage risk.

RELATED READING

What’s the difference between prevention alerts and RDR?

There are several chargeback prevention technologies on the market today. Alerts are one of the oldest and probably most well-known options. A newer and quite similar technology is Rapid Dispute Resolution (RDR).

Both tools allow disputed transactions to be refunded to avoid chargebacks. However the way they go about doing that is slightly different.

Here’s an overview of the two, their differences, and how they can be used together for more complete protection.

Factor

Prevention Alerts

RDR

Card brand

Mostly Visa and Mastercard, some American Express and Discover.

Visa only

Solution provider

You can receive alerts directly from the vendor, but the features and reporting are limited. Alerts via a solution provider are more robust.

You can receive RDR directly from some acquirers, but the features and reporting are limited. RDR via a solution provider is more robust.

Process

The cardholder’s bank issues an alert. Your solution provider receives the alert. You or your solution provider issues a refund and responds within 24-72 hours.

The cardholder’s bank initiates a dispute that triggers RDR. Visa receives the case and consults your pre-set rules. If rules apply, the disputed transaction is refunded.

Rules

You decide on a case by case basis what should and shouldn’t be refunded.

You set rules for what should and shouldn’t be refunded. For example, all disputes with reason code 10.4 or anything under $50.

Source

You or your solution provider manages refunds in your CRM or order management system.

Your acquirer refunds disputes directly from your merchant account.

Automation

Some solution providers can automate the process – such as locating the disputed transaction in your CRM, issuing the refund, and responding to the alert.

Your acquirer can automatically issue a refund.

Reconciliation

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Results

Prevention alerts typically prevent 30-40% of all chargebacks. Results improve as more banks adopt the technology.

Because RDR is integrated with all Visa issuers, the product is technically capable of preventing all chargebacks if you set your rules to refund everything. However, some banks haven’t fully adopted RDR, so results are usually around 90% of all Visa disputes.

Card brand

Prevention Alerts

Mostly Visa and Mastercard, some American Express and Discover.

RDR

Visa only

Solution provider

Prevention Alerts

You can receive alerts directly from the vendor or from a solution provider.

RDR

You can receive RDR directly from your acquirer or via a solution provider.

Process

Prevention Alerts

The cardholder’s bank issues an alert. Your solution provider receives the alert. You or your solution provider issues a refund and responds within 24-72 hours.

RDR

The cardholder’s bank initiates RDR. Your acquiring bank receives the RDR case and consults your pre-set rules. If rules apply, the acquirer issues a real-time refund.

Rules

Prevention Alerts

You decide on a case by case basis what should and shouldn’t be refunded.

RDR

You set rules for what should and shouldn’t be refunded. For example, all disputes with reason code 10.4 or anything under $50.

Source

Prevention Alerts

You or your solution provider manages refunds in your CRM or order management system.

RDR

Your acquirer refunds disputes directly from your merchant account.

Automation

Prevention Alerts

Some solution providers can automate the process – such as locating the disputed transaction in your CRM, issuing the refund, and responding to the alert.

RDR

Your acquirer can automatically issue a refund.

Results

Prevention Alerts

Prevention alerts typically prevent 30-40% of all chargebacks. Results improve as more banks adopt the technology.

RDR

Because RDR is integrated with all Visa issuers, the product is technically capable of preventing all chargebacks if you set your rules to refund everything. However, some banks haven’t fully adopted RDR, so results are usually around 90%.

Reconciliation

Prevention Alerts

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

RDR

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

RELATED READING

How much do prevention alerts cost?

Prevention alert pricing is set by the vendor that provides the solution (Ethoca or Verifi). Pricing is per alert and is usually in the $20-40 range.

A couple things to note about pricing:

- It’s not usually cheaper to go directly to Ethoca or Verifi instead of a solution provider. The price should be the same. And if you work with a solution provider, you’ll receive reporting, automation, and support — which is essentially free.

- The price may seem high, but alerts probably cost less than your chargeback fee. The difference is that you are paying for the alert fee instead of a chargeback fee since you are avoiding the chargeback. Aside from potentially saving money on chargeback fees, what you are getting is the gift of time and a healthy chargeback ratio — both of which are usually pretty valuable features!

- If you refund a disputed transaction via an alert but still receive a chargeback, you’re entitled to a credit. So you basically have guaranteed success (if you use the right solution provider!).

- The old expression, “you get what you pay for,” is true. There are solution providers out there with super low pricing. But they offer very little to no support. Ultimately, you’ll pay less for each individual alert, but you’ll get way more alerts than you should.

- As you consider pricing, also consider contract terms. We recommend you work with a solution provider that doesn’t require a long-term contract. If alerts end up not being a good fit for your business or you don’t like the level of support being offered, you’ll want the ability to make changes. Don’t lock yourself into a long-term, bad situation just because pricing seems more appealing. If a service provider does require a long-term contract, there is probably a reason. Providers with a great product and support don’t need to force their customers to stick around!

Check our guide to learn more about alert pricing.

RELATED READING

Next steps

If you are ready to get started with prevention alerts, let us know. We can usually onboard new merchants in about 24 hours.

If you’re still trying to decide if alerts are a good fit for your business, check our additional resources.

- 3 Integration Options for Prevention Alerts

- Ethoca vs. Verifi: How Do the Prevention Alerts Compare?

- Why Would I Get Alerts From AltoPay Instead of Ethoca or Verifi?

- Why Can’t I Prevent All Chargebacks with Alerts?

- What are the Pros and Cons of Prevention Alerts?

- Chargeback Prevention: Alerts vs. RDR

- How Much Do Prevention Alerts Cost?

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.